On November 8, 2016, India’s government did something almost no one saw coming.

Send by emailIn an unscheduled announcement carried live on television, Prime Minister Narendra Modi said the government would cease to recognize two high-denomination cash notes, the INR500 and INR1,000 bills, as of midnight.

The move had the intended effect of cracking down on undeclared cash stores—often called “black money”—commonly held by the middle and upper classes to avoid taxes.

The declaration initially sowed chaos in India, a country with a low rate of credit card penetration where cash was still the predominant form of payment for a very large segment of the population. In fact, it was widely reported that the INR500 and INR1,000 bank notes made up 86% of the value of cash in circulation at the time.

But there was one segment of the business sector that stood to benefit from the demonetization move: digital payments.

Payment platforms like Paytm (which counts Chinese ecommerce giant Alibaba as one of its backers) saw an immediate and dramatic uptick in both user and transaction numbers following Modi’s announcement.

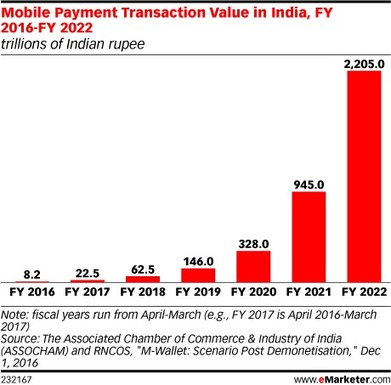

The Associated Chamber of Commerce & Industry of India (ASSOCHAM) and RNCOS released an estimate late last year that projected total mobile payment transaction value in India would climb to INR2.2 quadrillion ($32.8 trillion) by fiscal year 2022, hastened by the demonetization move.

Sourced through Scoop.it from: www.emarketer.com

Leave A Comment