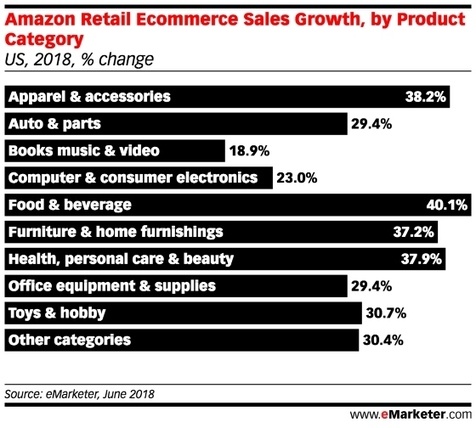

According to eMarketer’s latest forecast, Amazon’s ecommerce share of food and beverage sales in the US will reach 31.8% in 2018. Only auto and parts will capture a lower share. And with $4.75 billion in sales, food and beverage will also rank last by product category. However, food and beverage will post sales growth of 40.1% this year, tops among all categories.

Amazon isn’t alone in trying to crack online grocery sales. Walmart has come on strong, Target hasn’t dropped out of the running and traditional supermarkets, Kroger in particular, have been investing heavily.

Same-day delivery is proving to be a battlefield in the online grocery sector. Despite so-so interest in receiving packages in mere hours for other categories, a majority of US internet users (64%) would be interested in same-day delivery of groceries, and 19% have tried it. Amazon has been offering "free" two-hour delivery for Whole Foods orders of $35 or more via its Prime Now service in select cities and has plans for a nationwide rollout by the end of 2018.

One of the biggest stumbling blocks to selling groceries online has nothing to do with delivery or prices, though. People simply like to see, touch and smell food for themselves, which is why Whole Foods has widened Amazon’s playing field.

Fresh food isn’t what shoppers buy most on Amazon. According to One Click Retail, beverages have dominated Amazon’s share of grocery sales. In Q2 2018, sales of cold beverages grew 36% year over year to reach around $140 million, while coffee sales grew 40% to $135 million. Coffee pods were four of Amazon’s top five grocery items sold.

How Amazon is going to leverage Whole Foods’ brick-and-mortar presence is still evolving. Things happen so rapidly that it’s easy to forget that Amazon started offering 10% off sale items at Whole Foods for Prime members just two months ago. Amazon cross-marketed further on Prime Day, giving $10 credits to use during the 36-hour event to Prime members who spent $10 or more at Whole foods from July 11 to July 17.

Sourced through Scoop.it from: retail.emarketer.com

Leave A Comment