Walmart could overtake Amazon as the largest digital grocery player in the US by the end of 2018 and account for 17% of sales by 2025, a Deutsche Bank Securities report from October suggested.

That would be an impressive feat in just one year. In 2017, Amazon made up 12.5% of US digital grocery sales, compared with Walmart’s 11.1%, according to the report.

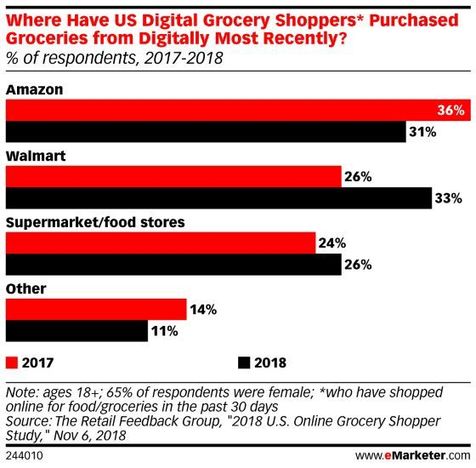

More evidence that Walmart could surpass Amazon comes from a September survey by The Retail Feedback Group, which showed that 33% of US digital grocery shoppers made their most recent purchase on Walmart’s site, ahead of Amazon (31%). In 2017, Amazon was ahead of Walmart by 10%.

Walmart’s rise in digital grocery sales is due partly to its investments in curbside pickup, which is currently available in more than 2,000 stores. Amazon also has curbside pickup options at Whole Foods locations in 22 US cities, but it’s available only to Prime members.

Curbside pickup and other click-and-collect models make sense for groceries because it gives shoppers a chance to review their order for quality and freshness before completing a transaction. Concerns over not receiving the highest-quality items have been a barrier to digital grocery adoption in general.

Speaking about digital grocery buyers in France, Mudit Jaju, global head of ecommerce at Wavemaker, said curbside pickup also allows shoppers to "pick up their orders at their own leisure" and "not be locked into a 2-hour delivery window."

Thanks mainly to a service called Drive, click-and-collect is the primary fulfillment method for digital grocery orders in France.

In the US, it’s also picking up speed. According to Market Force Information, 14.9% of US grocery buyers had bought groceries online and picked up in-store as of June 2018, up more than 10 percentage points from 2016.

Sourced through Scoop.it from: retail.emarketer.com

Leave A Comment