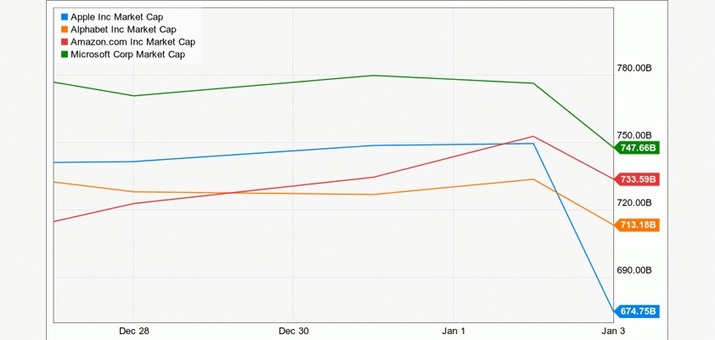

Apple falls to fourth place

Remember when Apple was the world’s most valuable company? (Two months ago) Or when it became the first trillion dollar American public company? (Five months ago.) Well as of this morning, Apple sits in the No. 4 spot on the valuation charts ($675 billion), having fallen yesterday past Alphabet ($710 billion) and Amazon ($734 billion). Microsoft, at $748 billion, retains top honors.