AmazonFresh, Amazon Pantry and Amazon’s Whole Foods operation cater specifically to the consumer packaged goods (CPG) market. But almost none of the retail giant’s CPG sales come from Amazon-branded goods.

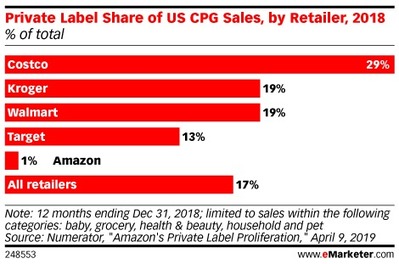

An April 2019 Numerator report shows that only 1% of Amazon’s CPG sales come from private-label products. Other major retailers see 13% to 29% of their CPG sales come from their private-label brands.

While Amazon-branded CPG products are growing at 81%, the business still has miles to go before reaching the private-label share that its competitors maintain.

“As a more recent entrant into the grocery space, Amazon is still well behind the competition when it comes to private-label CPG,” said Andrew Lipsman, principal analyst at eMarketer. “With all the talk of Amazon competing with sellers on its platform, this is a good reminder that the situation isn’t especially unique. At the same time, it highlights Amazon’s massive opportunity as it wades deeper into online grocery—and why CPG brands already contending with tight margins won’t welcome the added competition.”

Amazon has recently expanded its exclusive brands portfolio, which is now rapidly outpacing its number of private-label brands. March 2019 data from Gartner L2 found that Amazon had 52 exclusive grocery brands and just five private-label grocery brands. This discrepancy was similar for other CPG-heavy categories such as pet and beauty.

Sourced through Scoop.it from: www.emarketer.com

Leave A Comment