Bank employees are being laid off worldwide. Negative interest rates, political uncertainty and threats of trade wars on a global level have all played their part in eroding banks’ balance sheets, along with interest rate cuts which further reduce margins.

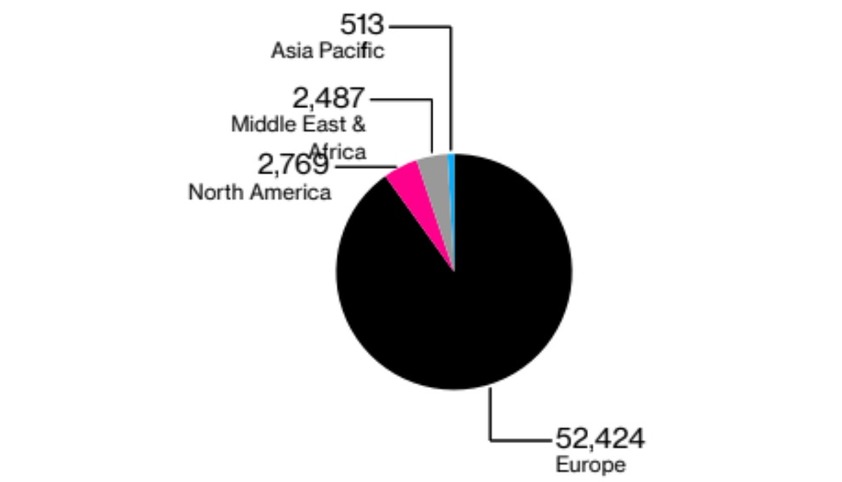

According to year-to-date company filings and labor union disclosures compiled by Bloomberg, banks have announced that they are cutting 58,200 jobs so far this year. The biggest layoffs are in Europe, where 52,424 jobs, or 90% of the total layoffs, are being slashed, as the European banking sector continues to struggle with profitability. Moreover, 2,769 workers in North America are being let go, as are 2,487 in the Middle East and Africa and 513 in the Asia Pacific region.

Furthermore, the data shows ten banks that have laid off the most workers in Europe, with Deutsche Bank leading the pack with 18,000 job cuts. The other banks on the top 10 list are Banco Santander, Commerzbank, HSBC, Barclays, Alfa Bank, KBC, Societe Generale, Caixabank, and the National Bank of Greece.

German Banks Lag Behind Others

The health of Germany’s financial sector has been a top concern for regulators and politicians for quite some time. The low interest rate environment, a global economic slowdown, trade tensions, geopolitical uncertainty, added to structural vulnerability and domestic economic weakness, have negatively impacted German banks. Lenders in Europe’s largest economy sit on large deposits so they are more dependent on lending than those in many other European countries.

The European banking sector has long faced calls for consolidation as banks struggle to generate profits. Two leading German banks — Deutsche Bank and Commerzbank — have attempted a merger, but it fell through early this year, resulting in the pair independently announcing major layoffs.

Sourced through Scoop.it from: news.bitcoin.com

Leave A Comment