The crucial question facing Wall Street executives is whether to build this tech-ready culture in-house or buy it by acquiring fintech startups. While there have been some big-name acquisitions — most notably Blackrock’s 2015 acquisition of online robo-advice firm FutureAdvisor and Goldman Sachs’ 2016 purchase of digital retirement-savings app Honest Dollar — and many banks’ venture arms have been pouring investment into fintech startups, the rising trend is for less formal partnerships between the Davids and the Goliaths. JPMorgan Chase has partnered with online business loan provider OnDeck to co-create a new loan product; Bank of America-Merrill Lynch is collaborating with Microsoft on implementing a blockchain-based financial-transactions platform; Capital One has partnered with fintech companies Bill.com and Gusto to provide better financial management tools to its small-business customers.

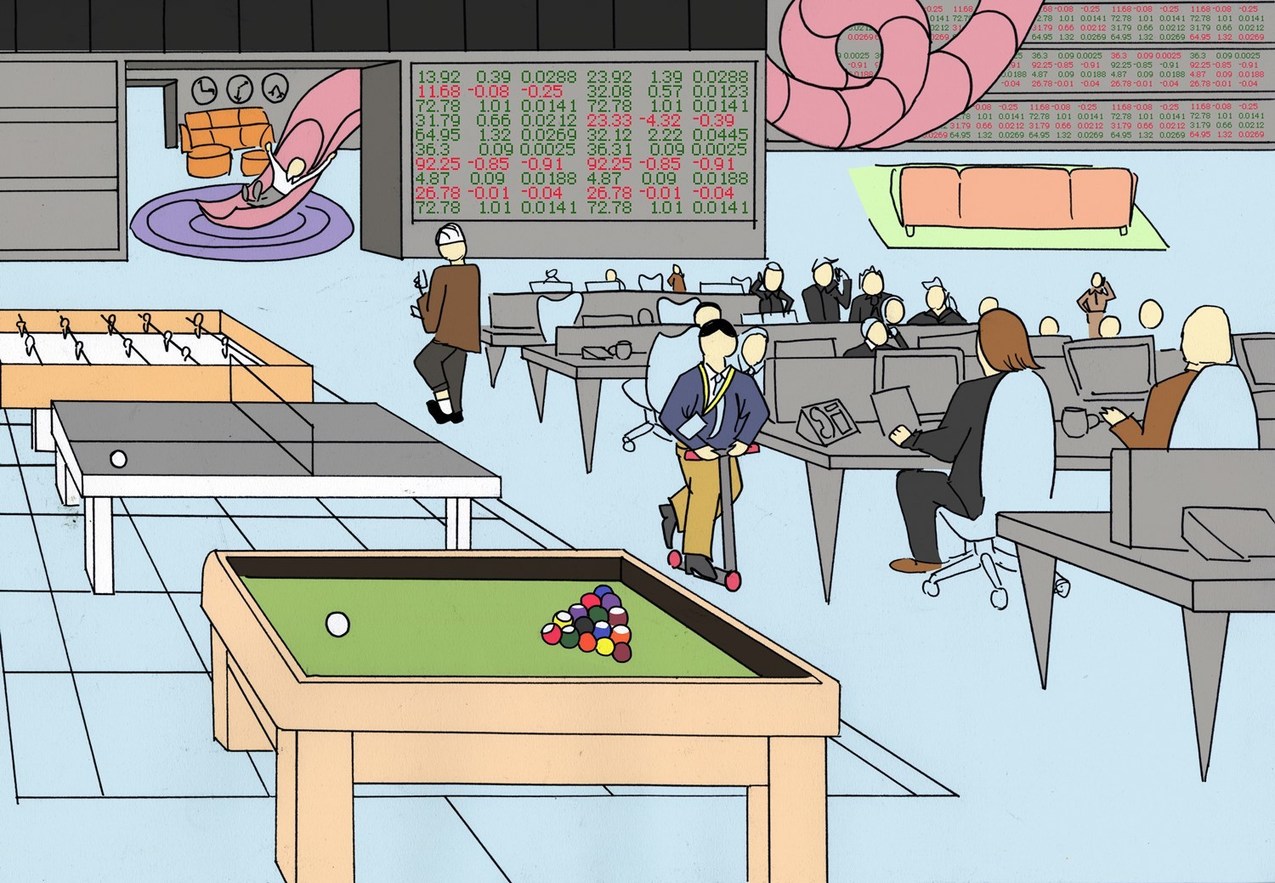

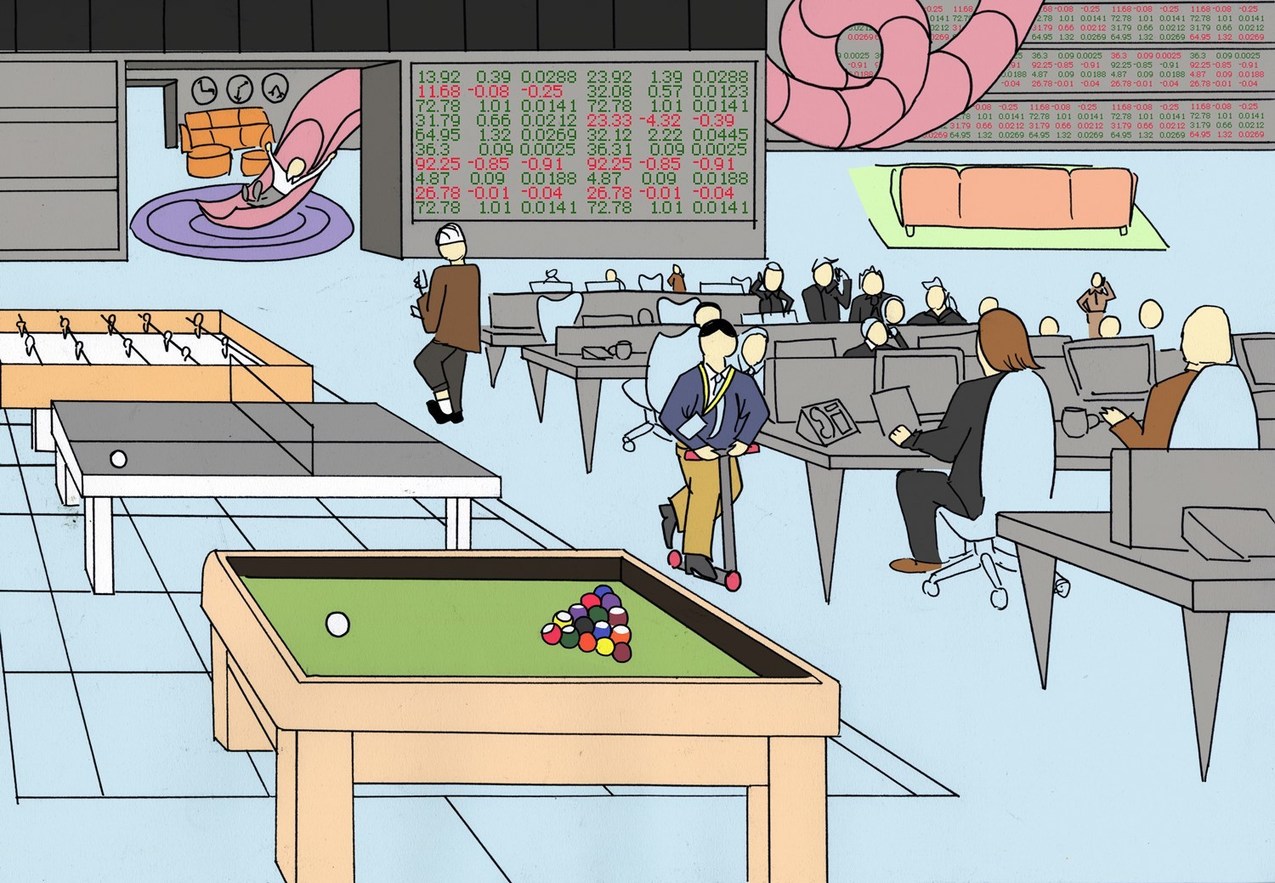

And then there are the companies that have set up Silicon Valley-based outposts so innovation can occur in satellite campuses away from the mother ship — Wells Fargo’s San Francisco-based Digital Labs showcases touch screens and virtual reality simulations of its new products; in addition to San Francisco, Citi has innovation hubs in Tel Aviv, Dublin, Singapore and New York City. Meanwhile, the website for Capital One’s innovation labs boasts that its various locations feature arcade machines, Ping-Pong tables, a speakeasy and even “a shuffleboard table and a napping nest.” Ernst & Young has trademarked the name of the cultural approach to innovation in its Financial Services Innovation Center: “Suits + Jeans.”

But despite the rise of the big players increasingly finding alternatives to acquisition, almost two-thirds of fintech founders and investors expect their companies’ ultimate exit strategy to be via acquisition, rather than an independent IPO, according to a recent U.K.-based fintech survey from law firm Mayer Brown.

***

It’s unclear which strategy will prove most successful in managing the technological transition. Back at Harvard’s recruiting fair, at least one computer science major is not convinced by the big players’ attempts at tech recruiting. The finance world in general no longer appeals to Katarina (not her real name) because of its negative social impact, she says. Instead, she wants to focus on coding and building things. But Silicon Valley isn’t a cultural haven either — the perceived misogynistic culture at many tech firms (including scandals at Uber and 500 Startups) is a turnoff for her too. Katarina interned at Goldman last year, but has no intention of returning; instead, “smaller trading companies have been attracting a lot of tech people because they incorporate tech culture,” she says — D.E. Shaw’s pajama pants have clearly worked their magic.

Sourced through Scoop.it from: www.ozy.com

Leave A Comment