The news that Starbucks was among the companies working with Intercontinental Exchange on creating a platform called Bakkt that will allow consumers to "buy, sell, store and spend digital assets on a seamless global network" was widely interpreted as a sign that the coffee giant was set to accept cryptocurrency payments.

Not exactly. The idea, according to Starbucks, isn’t to take Bitcoin as currency for pumpkin spice lattes but rather to enable the exchange of Bitcoin for US dollars to spend at Starbucks.

Even so, is the fact that a major US company is getting involved with cryptocurrency a signal that this niche payment method is mainstreaming, or is it simply a customer-centric retailer offering more options?

Most internet users worldwide are aware of cryptocurrency, but fewer than half own it. When polled in February by SharesPost, 71% of cryptocurrency owners planned to buy more this year, and 21% of non-owners planned to start.

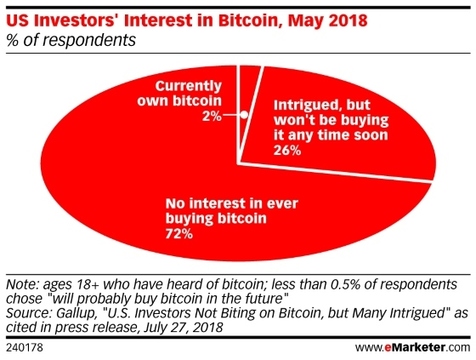

But a more recent US-focused survey by Wells Fargo showed far lower levels of adoption and interest, perhaps due to the plunge Bitcoin experienced this year. In May 2018, 72% of US investors (adults who have invested $10,000 or more) had no interest in ever buying Bitcoin. Just over one-quarter were interested, though. Higher levels of men (30%) and consumers under age 50 (41%) were interested but holding off on buying Bitcoin.

Starbucks might be the highest profile company getting involved with cryptocurrency, but it’s not alone. Overstock.com became the first major retailer to accept Bitcoin in 2014. According to The New York Times, the online retailer generates roughly 0.2% of its revenues from cryptocurrency.

Sourced through Scoop.it from: retail.emarketer.com

Leave A Comment