While digital-only businesses appear modern, there is a growing backlash to cash-free commerce as it becomes more common. Many perceive it as discriminatory to low-income consumers and the unbanked while cities like Philadelphia and Washington DC have been trying to pass legislation banning cashless merchants.

According to a recent study by Cardtronics, 60% of US internet users said cash was the most available payment method for everyone, and another 90% viewed cash as essential to those without checking or savings accounts.

What’s more, roughly one-quarter (28%) of respondents said they prefer to pay with cash. Of that, a plurality (64%) reported feeling nervous when they didn’t have cash on them.

That said, the study found that the most popular payment method was debit cards (37%) while 20% of respondents said they preferred credit cards. Mobile payments (13%) and checks (2%) were preferred by a small minority.

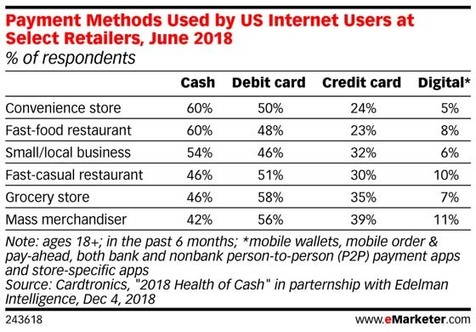

But these preferences are situational. Most consumers preferred cash for small purchases—essentially items between $20 and $30. And cash rules for many retail formats: fast food outlets, convenience stores and small businesses. Meanwhile, debit cards were most used at grocery stores and mass merchandisers.

Sourced through Scoop.it from: retail.emarketer.com

Leave A Comment