Facebook released better-than-expected results on July 24, reporting $16.9 billion in revenues, 1.59 billion in daily active users (DAUs), and $7.05 in average revenue per user (ARPU). This came just as the company was fined a record-setting $5 billion by the Federal Trade Commission (FTC) as a result of the 2018 Cambridge Analytica scandal.

Our thoughts

“This company has repeatedly shown that it can grow both its ad revenues and user base, even in the face of enormous challenges," said Debra Aho Williamson, principal analyst. "Its earnings release demonstrates that it still has that power."“We expect Facebook’s worldwide ad revenues will increase 22.5% this year. That’s a higher growth rate than for digital advertising as a whole, which we expect will increase 17.6%. The FTC settlement, which was announced the same day as Facebook’s earnings, doesn’t appear to have direct impact on Facebook’s ad business, but other regulatory or governmental investigations may have an impact in the future. We also think that Facebook will continue to scrutinize its own business practices and could decide to make changes to its targeting capabilities on its own.”

eMarketer’s Facebook estimates

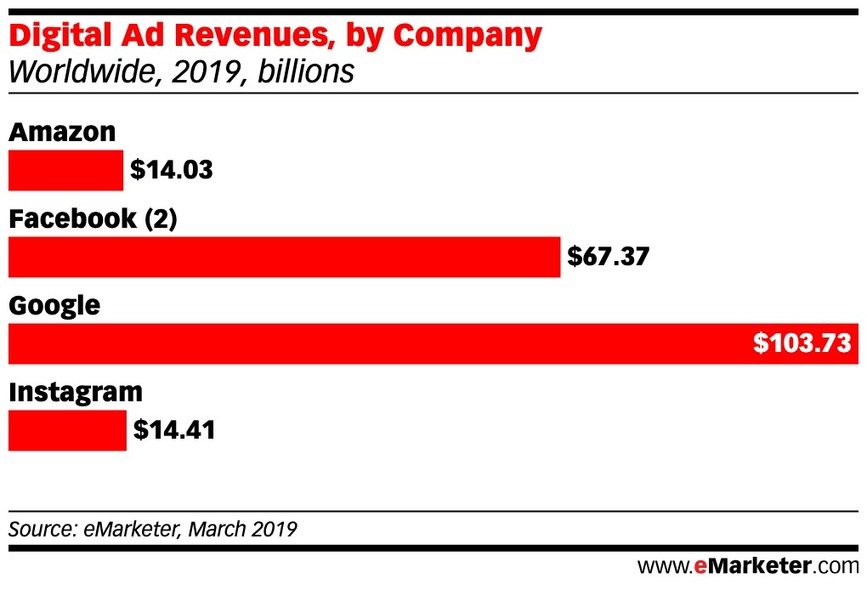

Facebook’s worldwide digital ad revenues will be $67.37 billion this year (including Instagram’s $14.41 billion), which will increase 20.1% to $80.93 billion next year. The company currently controls a 20.2% share of the worldwide digital ad market, right behind Google (31.1%).There are roughly 1.76 billion monthly Facebook users worldwide, which is up almost 6% vs. last year.

Amazon

Results

Amazon reported revenues of $63.4 billion in its Q2 earnings delivered on July 25, a 20% increase from the same period last year. Its Amazon Web Services (AWS) made $8.4 billion in sales, and subscription services made $4.7 billion, which is 37% up from last year.Our thoughts

“Amazon has a decidedly mixed bag in Q2, with exceptional top line revenue growth but some cause for concern on the bottom line,” said Andrew Lipsman, principal analyst. “Increased costs for one-day delivery were baked in and likely helped on the top line, but the unexpected hit to profits came from the slowdown in the cloud business. Heightened competition from Microsoft and Google could really crimp this high margin revenue stream over the next few quarters.”eMarketer’s Amazon estimates

Amazon’s US ecommerce sales will grow another 17.7% this year to $221.13 billion. This gives the company more than a one-third (37.7%) share of the US ecommerce market. US ecommerce sales total $586.92 billion, which is 10.7% of all US retail sales.We also estimate that for the first time, more than half of US households (51.3%) will be Prime members.

Results

Alphabet, Google’s parent company, reported revenues of $38.94 billion in Q2 2019, which is up 19% from the same period last year. Its traffic acquisition costs, or how much it paid to affiliates that direct traffic to its website, were $7.24 billion, which made up 22% of its total ad revenues.Our thoughts

“With a showing quite similar to Q1, Google’s Q2 earnings again display the moderating growth that has come to characterize 2019 for the company,” said Monica Peart, senior forecasting director. “Strength in mobile advertising is holding search ad growth steady and in a positive turn of events, global currency positions are beginning to stabilize against the US dollar, giving Google ad revenues minor relief vs. Q1.”eMarketer’s Google estimates

Google remains the dominant company in worldwide search ad spending, and we estimate that it will capture 61.1% of the search market worldwide, generating $103.73 billion in net digital ad revenues this year.

Sourced through Scoop.it from: www.emarketer.com

Leave A Comment